Living Overseas? Understanding Your Tax Requirements As A British Expat

If you’ve moved abroad, it’s important to be aware of your key tax requirements to ensure that you’re compliant. Many expats wrongly believe that, once they are no longer a UK resident, they are exempt from…

5 Minute Read

Last Updated: 20th September 2023

If you’ve moved abroad, it’s important to be aware of your key tax requirements to ensure that you’re compliant. Many expats wrongly believe that, once they are no longer a UK resident, they are exempt from UK tax – but this isn’t the case.

The issue of tax can further confuse those expats who have decided to rent their original property out in the UK. How exactly you define your residency can cause even further perplexity when it comes to knowing your tax status and therefore your tax requirements.

Thankfully, we’ve summed up the entire process in this easy-to-digest guide.

Determining your residence status

Tax isn’t the most straightforward thing to understand when you’re living outside of the UK, but with a little foresight, you’ll be prepared and compliant. Contrary to popular belief, you can’t simply become an expat somewhere and automatically adopt their tax system. The situation may be that you need to pay tax in both countries.

You will be classified as a UK resident if:

- You spend 183 or more days in the UK each year

- Your only home is in the UK and you spent at least 30 days in it in the last tax year – but you must have owned, rented or lived in it for at least 91 days in total

You will be deemed as a non-UK resident if:

- You were in the UK less than 16 days or, if you weren’t classed as a UK resident for the last three tax years, the number of days was fewer than 46

- You work abroad for an average of at least 35 hours a week (i.e. ‘full-time’), and you spent less than 91 days in the UK, without working more than 30 days there

If you’re classed as a UK resident, then you would pay UK tax on any income, regardless of whether this is gained within the UK or in another country. However, if your permanent home (i.e. ‘domicile’) is not in the UK, then you may not need to pay UK tax on foreign earnings.

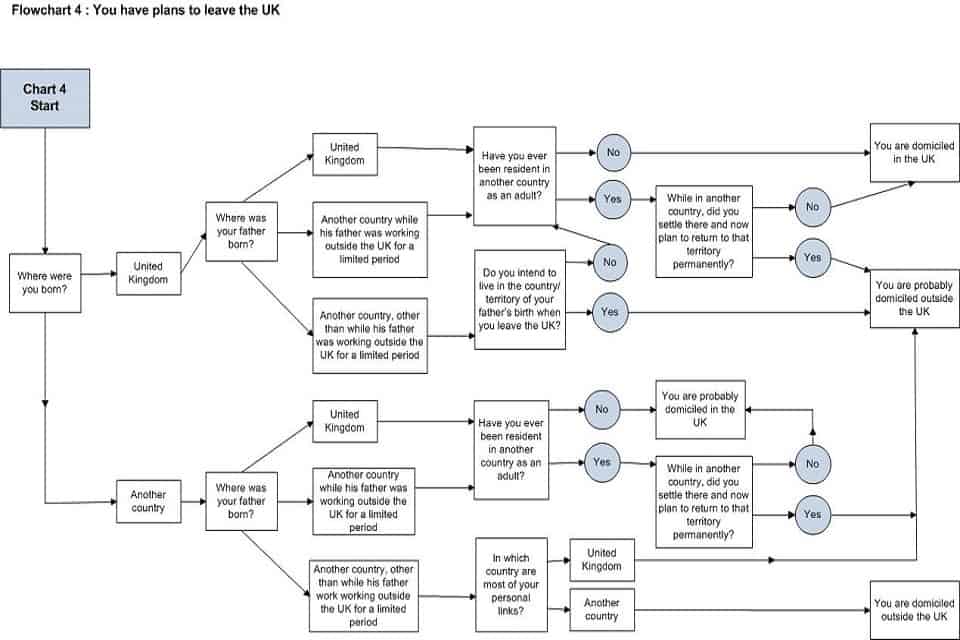

It’s important to work out your domicile. As a basic rule, your permanent home will be the country in which your father was born in. But if you move abroad and don’t propose to return, then your domicile can change. This does make the process of figuring out your permanent home more complicated, so HMRC have provided detailed guidance on this. Their following flow chart can also be used as a simple initial step towards determining it.

Defining your UK landlord status

Even if you’re classed as a UK resident, you’ll be a ‘non-resident landlord’ if you live abroad for six or more months of the given tax year. Therefore, whilst knowing your exact resident status and domicile will help with knowing how to pay other forms of tax, they won’t have an impact if this is your situation as a landlord.

The likelihood is that you will need to complete a tax return for landlords, though you may not have to necessarily deduct the tax yourself. There is the Non-resident’s Landlords Scheme, which permits either a letting agent or tenant to act on behalf of you with regards to tax contributions.

This scheme requires that they deduct basic rate tax from the rent due (after allowing for any expenses that they have paid the cost of), and provide you with a certificate which states the total tax they have deducted. The ‘letting agent’ doesn’t necessarily have to be acting in a professional capacity – they can be a friend or relative, as long as they manage the rental property and meet specific criteria.

Alternatively, if you receive the full amount of rent from the tenant, and pay the tax on it yourself, then you can easily request a NRL1i from HMRC to allow for this.

Submitting your Self Assessment

If you’re a landlord living abroad but renting out a property in the UK and therefore have rental income, you need to register this with HMRC.

Filing a tax return as a non-resident landlord isn’t the same as if you were a resident landlord – there are different procedures to follow. It’s also worth noting that HMRC’s online services are not able to be used in the process. Your Self Assessment tax return can be submitted by post – but this doesn’t offer as much time to meet the deadline. For example, if you have rental income from the tax year 2018/19, the due date is 31st October 2019. A digital method would give you extra time, until 31st January 2020 – and HMRC do allow the use of commercial software.

You’ll need to declare the rental income for the specific tax year, as well as any other UK income in your Self Assessment tax return. It will also be necessary to fill in the additional forms that relate to being a landlord in another country. These are the property form (SA105) and residence form (SA109).

For the SA105, you’ll need to declare information like:

- The total rent and other income you’ve gained through any properties

- Any expenses related to the home, for example repairs and maintenance

- Information relating to any capital allowances

The residence form will require you to provide information such as:

- Whether you’re eligible for split year treatment

- The date you left the UK

- The number of days spent in the UK in the specific tax year

- Any entitlement to claim personal allowances as a non-resident

- Information regarding your domicile/residential status

If your circumstances dictate that you have what’s classed as overseas income that needs to be declared to HMRC, you will need to file the foreign form (SA106). This requires specific information such as:

- Interest and income from overseas savings (if any)

- The overseas pensions, social security and royalties you may have

- Any claims for Foreign Tax Credit Relief

In the situation you overpay on tax, you may be able to apply for a refund. You can use the R43 form if either your tenant has already deducted the tax or if the rental income received doesn’t surpass your Personal Allowance.

Guaranteeing compliance as a non-resident landlord

The various pieces of data required for a standard Self Assessment can cause stress for anyone, let alone those who also need to submit additional pages as a British expat. We think reaping the rewards of UK rental income should be a hassle-free process. That’s why we created our Self Assessment software. This solution takes away the burden of the tax return through incredibly valuable functionalities, such as:

Easy usability

GoSimpleTax truly is your Self Assessment shortcut. Our tools have fantastic usability, so you can do the tax return all by yourself without any problems. You’ll quickly adapt to the features, and there are tutorials and support available should you need any.

Time-saving features

These features allow you to spend the minimum amount of time filing your tax information – they do all the work for you. You simply key in your details, and GoSimpleTax’s software will calculate your income, expenditure and the tax due in an instant. There are also tax-saving recommendations so you can reduce the amount you owe – no effort required.

Real-time visibility

Whenever you enter a figure, you’ll be able to see how your financial situation changes immediately. This means you will have a clear picture at any time of the year, and can take the necessary steps to improve it, if necessary. By having the capability to input your information whenever you choose, you can save the stress of a last-minute January submission too.

All-in-one solution

With our tax return software, your files and documents will be filed in one place. Therefore, you can keep on top of your tax affairs without wasting any time looking in different locations for the relevant documentation. You can even take photos of your receipts for expenses, meaning you can eliminate paper from the Self Assessment process altogether.

Expat-specific

As GoSimpleTax is an approved supplier for filing your tax information, you’re able to file directly to HMRC from any country without issue. We have all the necessary digital forms that are required to complete it. There’s no need to pay for recorded postal delivery to HMRC – you’ll be able to submit your tax return the simpler, secure way and receive instant confirmation too.

Suits your lifestyle

It doesn’t matter what device you use for your Self Assessment; you can get your tax affairs sorted regardless. You can even submit your tax return from your smartphone whilst you’re out and about.

Peace of mind

Ultimately, the very best feature that our GoSimpleTax software provides is complete assurance. You’ll be using tools you know are secure and compliant, and won’t need to worry about any repercussions from HMRC later down the line.

Plus, you can see how the software works for you at no cost. We offer a free trial. It really is the way to meet your British expat tax requirements with ease.

If you have any questions, feel free to get in touch with our friendly team today.

Blog content is for information purposes and over time may become outdated, although we do strive to keep it current. It's written to help you understand your Tax's and is not to be relied upon as professional accounting, tax and legal advice due to differences in everyone's circumstances. For additional help please contact our support team or HMRC.

How to keep track of your side hustle income and expenses

16 Apr 2024

12 things business partners should know about Self Assessment

15 Apr 2024

Everything you need to know about payments on account

31 Mar 2024

How GoSimpleTax Works

Register

Simply register for free with your full name and email address.

Select Your Income

Select the income you receive and follow the hints and tips for potential tax savings.

Validate Your Information

Validate your personal information and submit directly to HMRC to get confirmation in just seconds.

Work Anywhere, With Any Device

Gone are the days of fretting over a calculator surrounded by scraps of paper at the eleventh hour.

GoSimpleTax’s tax return software uses the information you upload in real time to calculate your income and expenditure, working out the tax you owe and sending you helpful notifications when there’s the possibility of a mistake.

"The software is intuitive and proved very easy to navigate. I found the whole process refreshingly simple. I saved a lot of money too!"

Steve J.

Ordained Presbyter

"Easy to use and value for money. Everything you need to do your tax."

Gordon J.

Self Employed

"It fills in all the forms and sends them to the Inland Revenue. Not expensive either. Takes the stress out of doing your tax return online."

Ross G.

Team Rector