GUIDING YOU THROUGH SELF ASSESSMENT

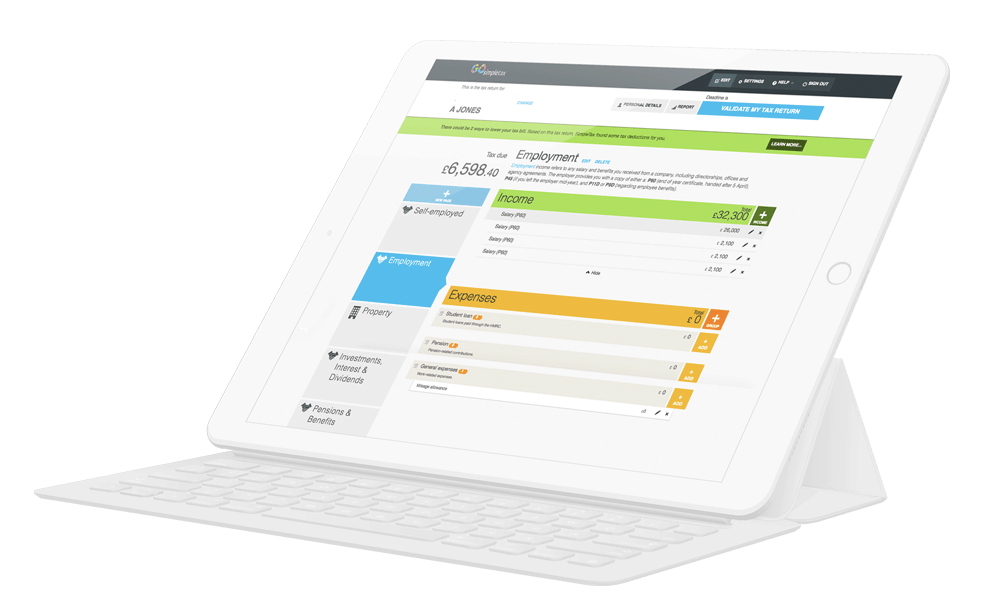

When using GoSimpleTax to complete your Self Assessment tax return we can support you in a few important ways:

Email

Support

Send your queries and we’ll answer them quickly and thoroughly.

Online

Support

Read answers to frequently asked questions and find solutions to your problems.

Expert

Guidance

Benefit from our highly experienced support team’s knowledge.

Self Assessment support when you need it

Email us with your Self Assessment tax return query and we’ll tell you the answer as soon as possible.

– Support hours are 9am-5pm Monday to Friday.

– In January, we offer support seven days a week to help ensure that you don’t miss the online filing Self Assessment tax return deadline.

Online Self Assessment tax return support

Whether you need to know more about what income to report, which expenses are allowable, what supplementary pages you need to fill in or anything else relating to Self Assessment, you can find the answers to frequently asked questions about Self Assessment and using GoSimpleTax on our online support pages.

Expert Self Assessment tax return guidance that’s reliable and free

Our friendly, customer focused support team is made up of Self Assessment tax return experts who know our software inside out. They can also draw upon decades of Self Assessment experience and latest knowledge, our customer support team includes highly qualified accountants, tax advisers and ex-HMRC staff.

Contact Us

Our Reviews on TrustPilot

PRICING

All plans are free to use and allow you to calculate your Self Assessment tax return, you only pay at the point you want to submit to HMRC, or unlock the many tax saving suggestions.

Free guides, tailored exactly to your circumstances are emailed after registration, so why wait? Register today.

⇤ Slide Left & Right ⇥

INDIVIDUAL

Key Features

-

Free Support

Email support Monday to Friday 9am – 5pm. (7 days per week in January).

-

100+ Tax Saving Tips

Our software suggests tips to help you save on tax.

-

Submit Directly to HMRC

Send your Self Assessment tax return directly to HMRC.

-

Self Employment (SA103)

Enter Sole Trade income and expenditure for each business you may have.

-

Property (SA105)

Enter property income and expenditure for the different rental types; Furnished holiday lettings, residential, commercial or rent-a-room.

-

Residency (SA109)

Notify HMRC of your residency/domicile, claim personal allowance or remittance basis, if relevant.

-

Basic Tax Return (SA100)

Complete your SA100 personal tax return and additional information pages.

-

Employment (SA102)

Enter P60, P45, P11D or other employment information (including expenses).

-

Ministers of Religion (SA102M)

Enter P60, P45 or other employment information, including expenses, as a Minister of religion.

-

Partnership (SA104)

Enter partnership profit/loss share (easily include entries from your partner statement).

-

Foreign (SA106)

Enter foreign income and gains [including foreign tax credit relief (FTCR)*] *manual calculation required.

-

Trusts (SA107)

Enter income received from a trust, settlement, or deceased person's estate (easily include entries from Form R185).

Please note: Only the individual’s income can be reported, form SA900 (used to file a full Trust and Estate Tax Return) is not supported. -

Capital Gains (SA108)

Include any gains or losses made (including any relevant relief claims).

-

Unlimited Income Per Month

Add all your income.

-

Unlimited Expenses Per Month

Add all your expenses.

-

Print Tax Calculation

You can print your tax calculation.

-

View Tax Calculation

Your tax calculation broke down into section.

-

View Tax Owed

See how much tax you owe in real time.

-

Self Assessment Categorisation

All Self Assessment categorisations.

-

Integrates with:

We ingrate with other apps to help you do more with your tax return.

-

FreeAgent

Our integration to FreeAgent allows users to import a trial balance into the self-employed page of a tax return.

-

FreshBooks

Import the Profit and Loss report from FreshBooks into GoSimpleTax.

-

SumUp

Connect your SumUp account with GoSimpleTax and pull through your transactions directly into your tax return.

-

Xero (Beta)

If you are a sole trader using Xero for your bookkeeping records then our integration will allow you to import your Profit and Loss report directly to the self employed page of your tax return.

See More +

Free TrialFriends & Family

Key Features

-

2 Returns - £89.99

File 2 Self Assessment tax return from the same tax year.

-

3 Returns - £120.99

File 3 Self Assessment tax return from the same tax year.

-

4 Returns - £145.99

File 4 Self Assessment tax return from the same tax year.

-

5 Returns - £161.99

File 5 Self Assessment tax return from the same tax year.

-

6 Returns - £181.99

File 6 Self Assessment tax return from the same tax year.

-

7 Returns - £192.99

File 7 Self Assessment tax return from the same tax year.

-

8 Returns - £202.99

File 8 Self Assessment tax return from the same tax year.

-

9 Returns - £204.99

File 9 Self Assessment tax return from the same tax year.

-

10 Returns - £205.99

File 10 Self Assessment tax return from the same tax year.

-

Additional Returns £1 Each

If you need to file more than 10 tax returns in the same tax year, you will be charged £1 for each additional return.

-

2 Returns - £148.99

File 2 Self Assessment tax return from the same tax year.

-

3 Returns - £179.99

File 3 Self Assessment tax return from the same tax year.

-

4 Returns - £204.99

File 4 Self Assessment tax return from the same tax year.

-

5 Returns - £219.99

File 5 Self Assessment tax return from the same tax year.

-

6 Returns - £240.99

File 6 Self Assessment tax return from the same tax year.

-

7 Returns - £251.99

File 7 Self Assessment tax return from the same tax year.

-

8 Returns - £261.99

File 8 Self Assessment tax return from the same tax year.

-

9 Returns - £263.99

File 9 Self Assessment tax return from the same tax year.

-

10 Returns - £265.99

File 10 Self Assessment tax return from the same tax year.

-

Additional Returns £1 Each

If you need to file more than 10 tax returns in the same tax year, you will be charged £1 for each additional return.

Partnership

Key Features

-

Free Support

Email support Monday to Friday 9am – 5pm. (7 days per week in January).

-

Submit Directly to HMRC

Send your Self Assessment tax return directly to HMRC.

-

Property Income (SA801)

Enter the income and expenses for any property income owned by the partnership.

-

Foreign Income (SA802)

Enter foreign income received by the partnership.

-

Disposal of Assets (SA803)

Enter disposals of any chargeable assets by the partnership.

-

Investments Income (SA804)

Enter any savings, investment or other income received by the partnership.

-

Add partners at anytime

Add partners to your tax return at any time.

See More +

Free TrialMeet our support team:

MIKE PARKES

TECHNICAL DIRECTOR

Mike has worked for HMRC and in practice for most of his 30 year career and has a detailed understanding of personal and small business taxation, bringing depth of knowledge to the product development process, driven by the users journey and maximising tax savings.

LOUISE PURKHARDT

HELP DESK

Louise started her tax journey working for HMRC as a Revenue Assistant/Revenue Officer for 11 years. Since then she’s gained over 18 years’ worth of experience working as a Tax Senior. Louise is driven by providing first class support to our users.

AIDEN CORCORAN

HEAD OF SUPPORT

Aiden started his tax journey working in practice 9 years ago. He completed his ATT qualification and more recently sat his Chartered Tax Advisor exams. Aiden has a wealth of tax knowledge and helps develop new services. Aiden can be booked for 1-2-1 tax reviews.

ZAK KHAN

HELP DESK

Zak joined the team as a Tax Support Apprentice and is currently completing his ATT qualification. He is developing his understanding of tax law as a whole with the aim of becoming a knowledgable advisor in regards to tax compliance.