4 Tips To Ensure You Don’t Miss The Self Assessment Deadline

Whilst HMRC send reminders to those required to complete the Self Assessment tax return, not everyone meets the tax return deadline. In fact, almost 750,000 taxpayers hadn’t submitted theirs when it passed in January 2018. And…

5 Minute Read

Last Updated: 28th June 2022

Whilst HMRC send reminders to those required to complete the Self Assessment tax return, not everyone meets the tax return deadline. In fact, almost 750,000 taxpayers hadn’t submitted theirs when it passed in January 2018. And of those who did manage to get it done in time, more than 30,000 completed the tax return in the last hour before the deadline.

How can you ensure that this doesn’t end up being you when 31st January hits? Here, we offer some tips to guarantee you won’t submit at the last minute, or miss the Self Assessment deadline altogether…

1. Remind yourself of the date

With all the information around one of the most key tax return dates, everyone should know the deadline – but this doesn’t mean memorising it is easy. Busy lives take over, and dates like the Self Assessment submission deadline fall to the back of your mind. But it needs to be prioritised. Therefore, treat it like you would a loved one’s birthday.

Firstly, mark it in your calendar – both online and in paper format – and set up an alert to prompt you at regular intervals in the run-up to the big day. You could even go one step further and put physical reminders around your workspace and at home.

There might be specific tasks related to the Self Assessment that need to be fulfilled before you can get started on it, such as logging an invoice. Make sure you trigger reminders to get them completed too.

2. Ensure your tax affairs are organised

One of the duties connected to the tax return could be gathering the evidence required, such as paper or online receipts for expenses. Rather than scrambling around trying to find these at the last minute, collate them well in advance of the deadline.

A good idea is to take photographs of any expenditure recorded in paper form at the time, and upload them along with any in a digital format into one sole place. This will make them easily locatable when needed.

You might also require certain answers to questions prior to completing your Self Assessment. Perhaps there is information related to your finances that you need input from someone else to know. Or maybe you are unclear on specific aspects related to the tax return, so need to contact HMRC.

As the deadline looms, financial professionals and HMRC will be busy. So to keep you from being put on hold with the Self Assessment helpline, ask any questions well in advance. If you get the answers you require as soon as possible, then this will limit any barriers with the tax return later down the line.

Remember the festive period too. Christmas celebrations can be distracting, and a busy time for others. The sooner you complete your tasks, the sooner you can join in with the festivities – and enjoy them to the full.

3. Think about the penalties

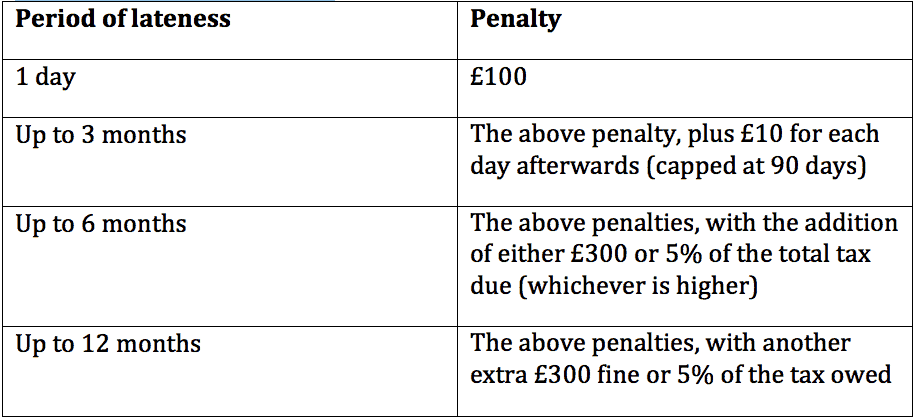

Getting motivated to submit the Self Assessment, especially around Christmas, can be hard. Tax calculations aren’t most people’s cups of tea, and it can feel easier to simply give up rather than to try. However, this will result in a monetary penalty.

Being aware of the current penalty system, along with the changes to this can be the ultimate drive for completing the tax return on time. Here’s a simplified breakdown (for 2017/18):

Even if it doesn’t seem like much money to lose, think about it this way: you’re still going to need to submit it eventually, but doing it later simply means you pay to do so.

Considering how the penalty fee could have been better spent is a good prompt too. For example, claiming on expenses minimises your tax liability so you spend less, but this money could potentially go to HMRC in the form of a penalty, meaning you might actually negate this saving.

4. Submit the Self Assessment with tax software

Tax savings like those gained from expenses might not initially be obvious to you, especially if you’re not an expert in these matters. This is where tax return software can help – GoSimpleTax notifies you of these, and helps you to complete the Self Assessment quicker too.

Its ease of use will guarantee you won’t miss the tax return deadline. With our software, the tax process is simplified – allowing anyone to quickly input their information and have their taxes sorted. There will be no calculations required by you either, as it acts as a Self Assessment tax calculator too.

You may find these other articles of interest

- 5 things to do now if you’ve missed the self assessment deadline for online filing

- 9 things you should know about missing the self assessment tax return online filing deadline

- Missed the self assessment deadline? Heres the fastest way to avoid being penalised

- What if you miss the self assessment tax return filing deadline?

Working in real time and able to be updated on the go, with GoSimpleTax by your side, you can keep ahead of the deadline and also prepare for Making Tax Digital.

To get yourself organised and submit the Self Assessment on time, test out the features of our software with a free trial.

Blog content is for information purposes and over time may become outdated, although we do strive to keep it current. It's written to help you understand your Tax's and is not to be relied upon as professional accounting, tax and legal advice due to differences in everyone's circumstances. For additional help please contact our support team or HMRC.

How to keep track of your side hustle income and expenses

16 Apr 2024

12 things business partners should know about Self Assessment

15 Apr 2024

Everything you need to know about payments on account

31 Mar 2024

How GoSimpleTax Works

Register

Simply register for free with your full name and email address.

Select Your Income

Select the income you receive and follow the hints and tips for potential tax savings.

Validate Your Information

Validate your personal information and submit directly to HMRC to get confirmation in just seconds.

Work Anywhere, With Any Device

Gone are the days of fretting over a calculator surrounded by scraps of paper at the eleventh hour.

GoSimpleTax’s tax return software uses the information you upload in real time to calculate your income and expenditure, working out the tax you owe and sending you helpful notifications when there’s the possibility of a mistake.

"The software is intuitive and proved very easy to navigate. I found the whole process refreshingly simple. I saved a lot of money too!"

Steve J.

Ordained Presbyter

"Easy to use and value for money. Everything you need to do your tax."

Gordon J.

Self Employed

"It fills in all the forms and sends them to the Inland Revenue. Not expensive either. Takes the stress out of doing your tax return online."

Ross G.

Team Rector