What Can I Claim in My Self-Assessment Tax Return?

What can I claim in my self-assessmenttax return? You may have been told that you’ll be able to claim back certain elements of expenditure when completing a self assessment tax return, but it’s hard to know…

5 Minute Read

Last Updated: 4th February 2022

What can I claim in my self-assessment

tax return?

You may have been told that you’ll be able to claim back certain elements of expenditure when completing a self assessment tax return, but it’s hard to know what is hearsay and what actually constitutes a “business expense”. See below for the costs you will be able to cover via a HMRC expenses claim – you may be aware of some, but others might just come as a pleasant surprise.

Travel

Whether you drive a vehicle or use public transport to get to meetings or you place of business, you should keep your tickets and receipts for everything – including fuel, parking, repairs and insurance – as these are allowable expenses if you’re self-employed.

Staff

Salaries and wages can be claimed on expenses, as can bonuses, pensions, National Insurance and other staff costs. You shouldn’t claim for carers or nannies, however.

Premises

Your allowable premises-based expenses are made up of the costs of items or services that will last for less than two years. These include stationery, rent, insurance, heating and lighting (this is also applicable to those who work from home – take a look at how to calculate your utilities expenses here).

Legal and Financial

If your business uses accountants, solicitors, surveyors or architects, you can claim their fees back on expenses. You can also claim for professional indemnity insurance premiums. However, the legal costs of buying property and machinery and fines for breaking the law are not considered tax deductible expenses.

Clothing

If your business requires you to purchase particular items of clothing, such as uniforms, costumes or protective garments, these can all be submitted to HMRC as expenses. You cannot claim for clothing that is not specific to the work you do.

Marketing, Subscriptions and Entertainment

You can also claim back for subscriptions to magazines that expand your specialist knowledge (though no politically oriented publications are permitted), along with the costs of bulk mail advertising, free samples and website costs if they are for use by your business.

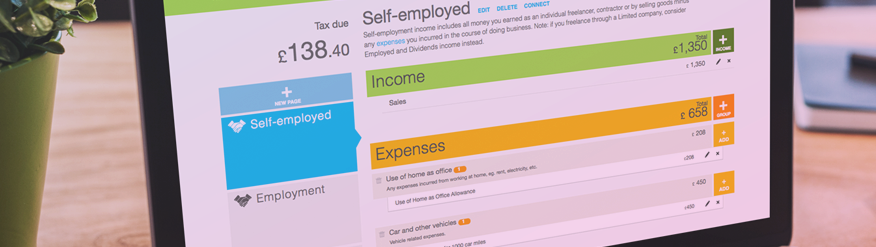

Make it Easier with GoSimpleTax

The GoSimpleTax app and online software allows you to upload your receipts in real time to help you quickly calculate your expenses when completing your self assessment. It will also automatically prompt you when it detects an opportunity to save money by claiming relevant expenses. This will save you a great deal of time trawling through your yearly expenditure when the time comes to submit a tax return!

Blog content is for information purposes and over time may become outdated, although we do strive to keep it current. It's written to help you understand your Tax's and is not to be relied upon as professional accounting, tax and legal advice due to differences in everyone's circumstances. For additional help please contact our support team or HMRC.

How to keep track of your side hustle income and expenses

16 Apr 2024

12 things business partners should know about Self Assessment

15 Apr 2024

Everything you need to know about payments on account

31 Mar 2024

How GoSimpleTax Works

Register

Simply register for free with your full name and email address.

Select Your Income

Select the income you receive and follow the hints and tips for potential tax savings.

Validate Your Information

Validate your personal information and submit directly to HMRC to get confirmation in just seconds.

Work Anywhere, With Any Device

Gone are the days of fretting over a calculator surrounded by scraps of paper at the eleventh hour.

GoSimpleTax’s tax return software uses the information you upload in real time to calculate your income and expenditure, working out the tax you owe and sending you helpful notifications when there’s the possibility of a mistake.

"The software is intuitive and proved very easy to navigate. I found the whole process refreshingly simple. I saved a lot of money too!"

Steve J.

Ordained Presbyter

"Easy to use and value for money. Everything you need to do your tax."

Gordon J.

Self Employed

"It fills in all the forms and sends them to the Inland Revenue. Not expensive either. Takes the stress out of doing your tax return online."

Ross G.

Team Rector