How UK Individuals Should Treat Cryptocurrencies For Tax Purposes

There is a lot of uncertainty within the UK cryptocurrency community as to how individuals should account for their cryptocurrencies gains/losses for tax purpose, and then how to file those tax returns when it comes to…

5 Minute Read

Last Updated: 5th April 2023

There is a lot of uncertainty within the UK cryptocurrency community as to how individuals should account for their cryptocurrencies gains/losses for tax purpose, and then how to file those tax returns when it comes to tax season.

We decided to write this blog to provide some clarity on the issue, and to show that thanks to our friends over at Recap, it is now nowhere near as complicated as it once was!

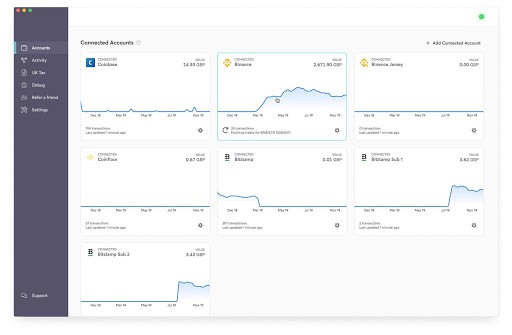

Recap can be used to gather all of your cryptocurrency portfolio and historic transactions in one, highly secure place. From here, users can gain an overview of their portfolio’s performance, look over historic transactions and, most importantly, generate a comprehensive capital gains tax report showing the total gain made from your cryptocurrency transactions in the chosen tax year.

The reason why cryptocurrency taxation is so complex in the UK is the way cryptocurrencies are treated for tax purposes. Cryptocurrencies are treated as ‘Cryptoassets’ by HMRC, meaning that they are treated similarly to shares for tax purposes.

Therefore, for every transaction an individual has ever made using cryptocurrencies, they need to determine the exact amount they paid for that amount of that specific cryptoasset. Due to the way disposals work for tax purposes, this could mean an acquisition made several years ago is the correct acquisition to match your recent disposal against.

As you can imagine, this can be a nightmare for even the most infrequent of traders, because it requires individuals to account for every single transaction they have ever made and calculate the value of that transaction in GBP at the time of the trade. Often, smaller cryptocurrencies don’t have a direct pairing with GBP or even USD, meaning the calculation must sometimes go as follows: cryptocurrency > BTC > USD > GBP in order to establish the cost of acquiring that specific amount of that cryptoasset on that date.

Have I bored you enough with the intricacies of UK Cryptoasset taxation already?

I thought I might have (Now spare a thought for the poor soul writing this blog post!). Luckily for you, I won’t cover much more on this now, but if you would like to find out more then head on over to our comprehensive UK cryptocurrency tax guide here (or our slightly more concise version here) which have both been created in association with certified tax professionals in the UK.

This is where Recap comes in. There is no longer a need to do all of these calculations manually or with the help of an accountant. Recap allows users to import data from their exchanges. All of this is done with end-to-end encryption (similar to WhatsApp or Telegram), meaning that the only person that can ever see your data is you – not even anyone at Recap can look at your cryptocurrency information!

Once a user has all of the data from their entire cryptocurrency ‘journey’ imported into Recap (It is important to have the entirety of your history of transactions present for acquisition and disposal purposes) they can generate a tax report in seconds. Recap’s tax engine was specifically designed with the UK tax regulations in mind, so incorporates all of the intricacies involved in UK cryptoasset taxation for individuals (such as bed and breakfasting).

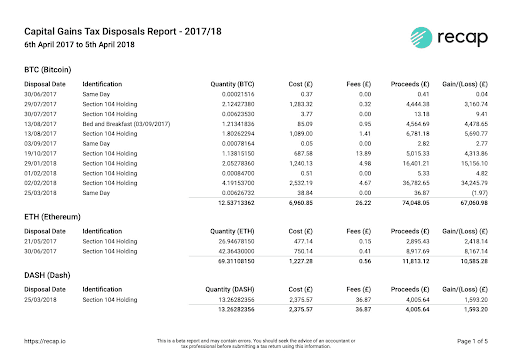

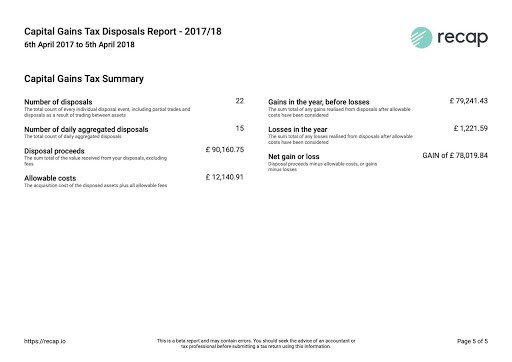

Below is an example of the report produced by Recap and the page displaying the final figure which can be used in an individual’s self-assessment tax return, which we will move onto next!

As you can see above, this individuals Capital Gains as a result of their cryptocurrency activities in the 2017/18 tax year amount to a net gain of £78,019.84 – This figure is net of everything HMRC allows to be deducted from disposal proceeds, such as the cost of acquisition and associated transaction fees.

Now that we have this net gain figure (for a net loss, see here for how you could use a net loss to offset future capital gains tax) the rest of the process is relatively simple.

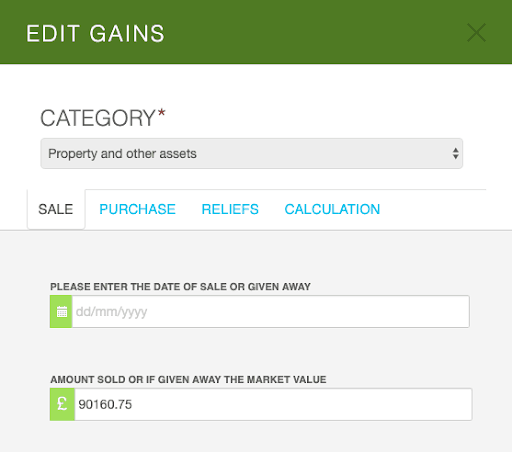

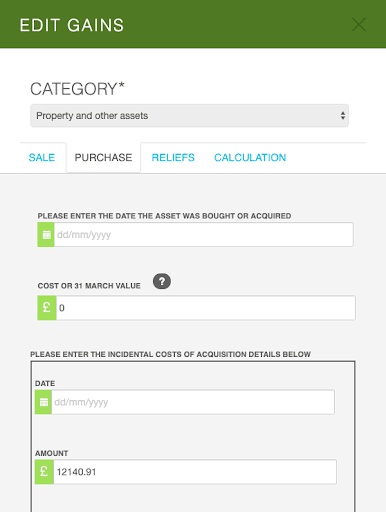

Tying this all to Go Simple tax, simply head over to the capital gains section (SA108) and select Add Gain, Category “Property and other assets”.

Enter the Disposal proceeds into the field AMOUNT SOLD OR IF GIVEN AWAY THE MARKET VALUE

Enter the Allowable costs under AMOUNT – PLEASE ENTER THE INCIDENTAL COSTS OF ACQUISITION DETAILS BELOW in the PURCHASE tab.

You should also attach the Recap disposals report to your tax return and keep a copy for your records.

We hope you found this article interesting and if you need any further help with your crypto taxes, head over to https://recap.io – the cryptotax experts.

Last updated 4th December 2019.

Blog content is for information purposes and over time may become outdated, although we do strive to keep it current. It's written to help you understand your Tax's and is not to be relied upon as professional accounting, tax and legal advice due to differences in everyone's circumstances. For additional help please contact our support team or HMRC.

How to keep track of your side hustle income and expenses

16 Apr 2024

12 things business partners should know about Self Assessment

15 Apr 2024

Everything you need to know about payments on account

31 Mar 2024

How GoSimpleTax Works

Register

Simply register for free with your full name and email address.

Select Your Income

Select the income you receive and follow the hints and tips for potential tax savings.

Validate Your Information

Validate your personal information and submit directly to HMRC to get confirmation in just seconds.

Work Anywhere, With Any Device

Gone are the days of fretting over a calculator surrounded by scraps of paper at the eleventh hour.

GoSimpleTax’s tax return software uses the information you upload in real time to calculate your income and expenditure, working out the tax you owe and sending you helpful notifications when there’s the possibility of a mistake.

"The software is intuitive and proved very easy to navigate. I found the whole process refreshingly simple. I saved a lot of money too!"

Steve J.

Ordained Presbyter

"Easy to use and value for money. Everything you need to do your tax."

Gordon J.

Self Employed

"It fills in all the forms and sends them to the Inland Revenue. Not expensive either. Takes the stress out of doing your tax return online."

Ross G.

Team Rector