Easy Software for Your VAT Returns

By using GoSimpleVAT, you can save yourself hours of valuable time and prevent the stress of completing your quarterly VAT return. Here are a few of the useful features included within GoSimpleVAT:

.

PRICING

All prices are exclusive of VAT and are based on a quarterly subscription.

⇤ Slide Left & Right ⇥

Freemium

Key Features

-

Submit Directly to HMRC - Free Support

- Basic Tax Return (SA100)

- Employment (SA102)

- Partnership (SA104)

- Ministers of Religion (SA102M)

- Foreign (SA106)

- Trusts (SA107)

- Capital Gains (SA108)

- Unlimited Income Per Month

- Unlimited Expenses Per Month

- View Tax Owed

- Integrates with:

- FreeAgent

- FreshBooks

- QuickBooks

- SumUp

- Xero (Beta)

See More +

Buy NowSA100 Tax Return

Key Features

- Submit Directly to HMRC

- Free Support

- Basic Tax Return (SA100)

- Self Employment (SA103)

- Property (SA105)

- Residency (SA109)

- Partnership (SA104)

- Ministers of Religion (SA102M)

- Employment (SA102)

- Foreign (SA106)

- Trusts (SA107)

- Capital Gains (SA108)

- Invoicing

- Unlimited Income Per Month

- Unlimited Expenses Per Month

- View Tax Calculation

- Print Your Tax Calculation

- Mobile App

- Scan Receipts

- Self Assessment Categorisation

- Integrates with:

- FreeAgent

- FreshBooks

- QuickBooks

- SumUp

- Xero (Beta)

See More +

Buy NowMULTIPLE RETURN DISCOUNT

Key Features

- 2 Returns - £89.99

- 3 Returns - £120.99

- 4 Returns - £145.99

- 5 Returns - £161.99

- 6 Returns - £181.99

- 7 Returns - £192.99

- 8 Returns - £202.99

- 9 Returns - £204.99

- 10 Returns - £205.99

- Additional Returns £1 Each

See More +

Buy NowSA800 PARTNERSHIPS

Key Features

- Submit Directly to HMRC

- Free Support

- Partnership Tax Return (SA800)

- Property Income (SA801)

- Foreign Income (SA802)

- Disposal of Assets (SA803)

- Investments Income (SA804)

- Auto populate partner’s SA104

- Add partners at anytime

See More +

Buy Now

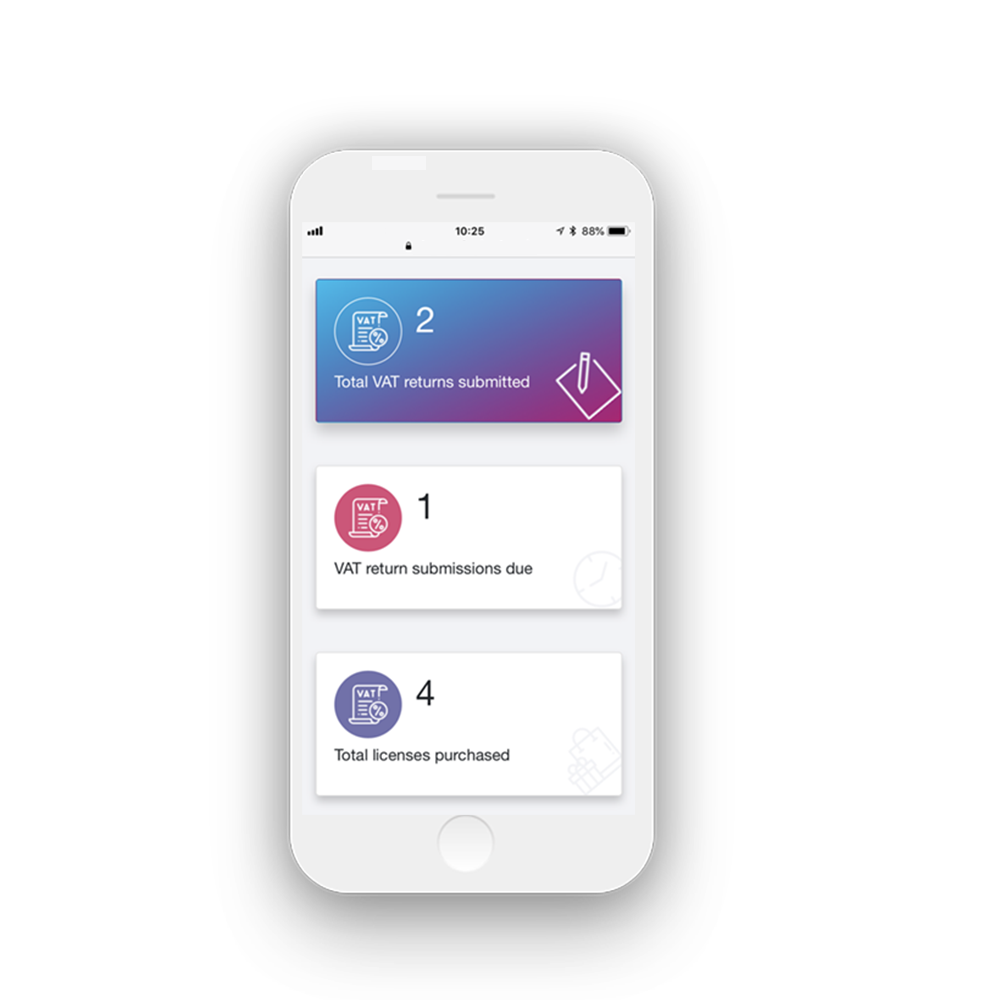

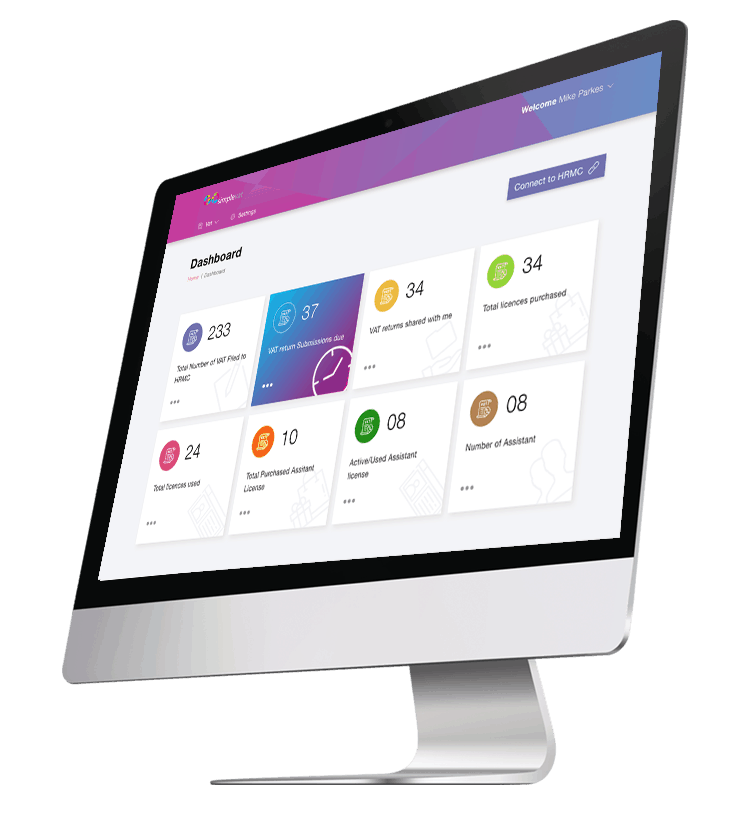

Read a VAT return from any software

Import VAT report calculations of the 9 box calculation from any third party software.

Future proof software that files directly to HMRC.

In keeping with HMRC’s rules of a digital journey, GoSimpleVAT reads directly from a PDF or spreadsheet of the VAT report – meaning no manual inputting required.

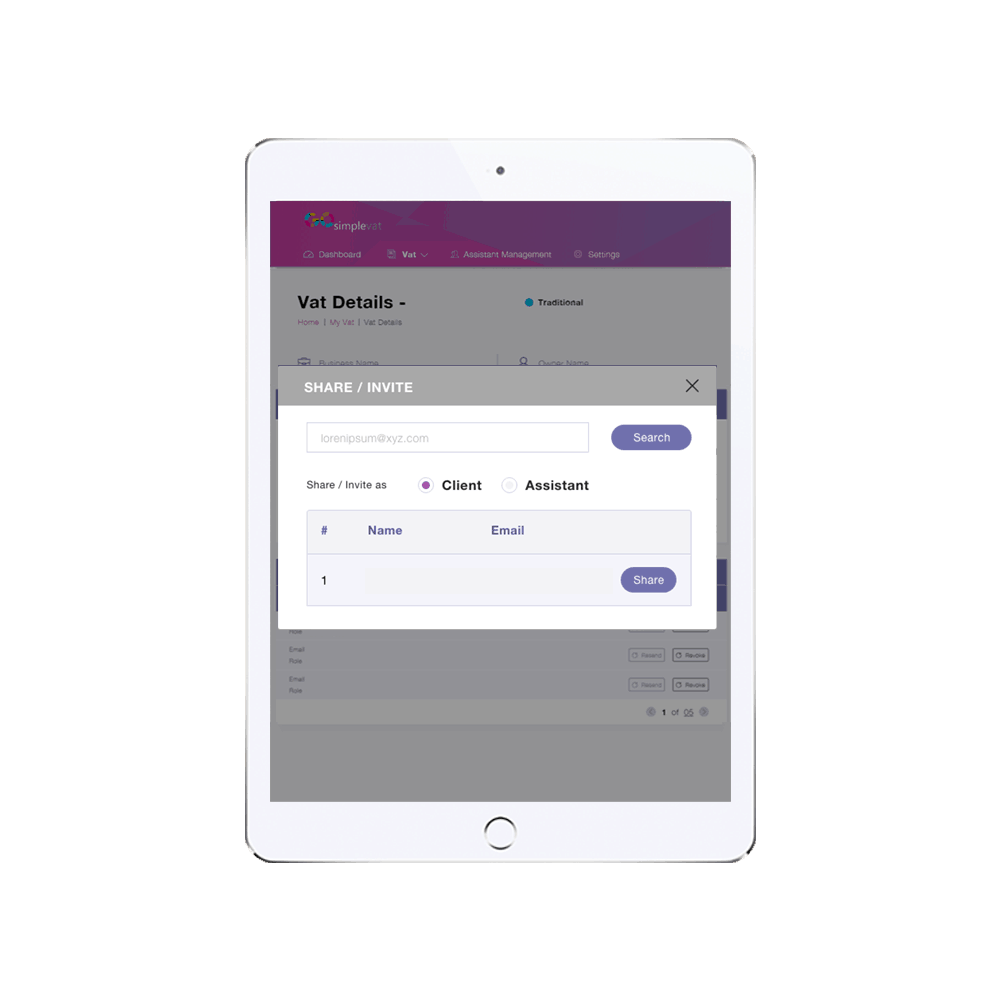

File multiple company's from one account

With GoSimpleVAT you can file multiple VAT returns from one account.