Be MTD-Ready. Quickly and Painlessly

Still filing paper returns? Choose a solution that digitally submits your accounts to HMRC. Making Tax Digital for VAT is here, and you need a tool that can evolve your processes.

With GoSimpleVAT, you can have just that. With our MTD for VAT software, you can complete and file your return online, backed by comprehensive data security.

.

PRICING

All prices are exclusive of VAT and are based on a quarterly subscription.

⇤ Slide Left & Right ⇥

Freemium

Key Features

-

Submit Directly to HMRC - Free Support

- Basic Tax Return (SA100)

- Employment (SA102)

- Partnership (SA104)

- Ministers of Religion (SA102M)

- Foreign (SA106)

- Trusts (SA107)

- Capital Gains (SA108)

- Unlimited Income Per Month

- Unlimited Expenses Per Month

- View Tax Owed

- Integrates with:

- FreeAgent

- FreshBooks

- QuickBooks

- SumUp

- Xero (Beta)

See More +

Buy NowSA100 Tax Return

Key Features

- Submit Directly to HMRC

- Free Support

- Basic Tax Return (SA100)

- Self Employment (SA103)

- Property (SA105)

- Residency (SA109)

- Partnership (SA104)

- Ministers of Religion (SA102M)

- Employment (SA102)

- Foreign (SA106)

- Trusts (SA107)

- Capital Gains (SA108)

- Invoicing

- Unlimited Income Per Month

- Unlimited Expenses Per Month

- View Tax Calculation

- Print Your Tax Calculation

- Mobile App

- Scan Receipts

- Self Assessment Categorisation

- Integrates with:

- FreeAgent

- FreshBooks

- QuickBooks

- SumUp

- Xero (Beta)

See More +

Buy NowMULTIPLE RETURN DISCOUNT

Key Features

- 2 Returns - £89.99

- 3 Returns - £120.99

- 4 Returns - £145.99

- 5 Returns - £161.99

- 6 Returns - £181.99

- 7 Returns - £192.99

- 8 Returns - £202.99

- 9 Returns - £204.99

- 10 Returns - £205.99

- Additional Returns £1 Each

See More +

Buy NowSA800 PARTNERSHIPS

Key Features

- Submit Directly to HMRC

- Free Support

- Partnership Tax Return (SA800)

- Property Income (SA801)

- Foreign Income (SA802)

- Disposal of Assets (SA803)

- Investments Income (SA804)

- Auto populate partner’s SA104

- Add partners at anytime

See More +

Buy Now

VAT Filing With HMRC Has Never Been Easier

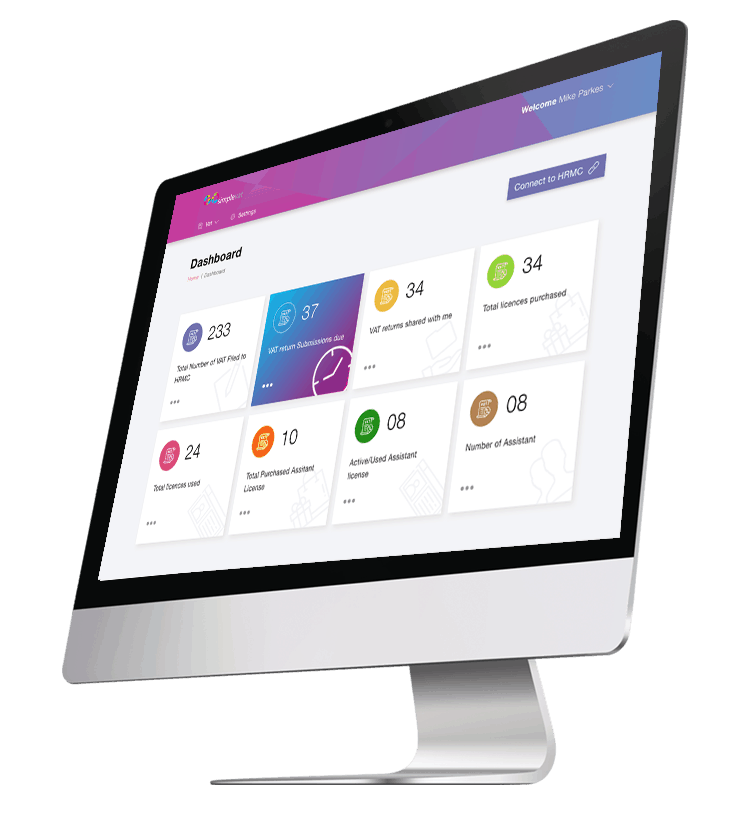

GoSimpleVAT can future-proof your business with our fully approved VAT software. Whether you’re filing XML or MTD-compatible VAT returns, our streamlined process gives users accessible information regarding their finances with easy-to-understand dashboards. And, if you have any queries during your digital transition, we offer expert email support too.

Easy Integration With Any Accounting Software

Recording tax online gives you more control and visibility over your finances.

Online VAT return software is your means of monitoring returns and having complete peace of mind. At GoSimpleVAT, we go a step further. With your mobile, you can access your VAT returns wherever you are using any third-party software.

Unrivalled Bridging Software For Excel Spreadsheets

Worried about migrating from spreadsheets? There is another option.

Our bridging software enables you to keep the methods that work for you. Due to Making Tax Digital, Excel files need to be submitted in a way that connects with HMRC’s systems. If you use Microsoft Excel for Windows (and for Mac), you’ll be glad to know that GoSimpleVAT augments records and returns so that they’re compliant.

An MTD Gateway With Multiple Third-Party Support

We understand that most businesses will have legacy systems that are core to their processes. GoSimpleVAT work around those processes to create a solution that is bespoke to you. So, whether you use Quickbooks, Zoho, Xero, Sage, FreeAgent, or FreshBooks, GoSimpleVAT offers complete support of third-party VAT spreadsheets and PDF exports.

What Is Making Tax Digital?

Making Tax Digital is the government’s new initiative designed to make tax easier and more accurate. It involves keeping digital financial records and using software to file online tax returns.

MTD for VAT is the first phase which launched in April 2019, applicable to businesses whose taxable turnover exceeds £85,000 (as of 2019/20). These organisations need to submit VAT returns online using MTD-compliant software.

It is expected that the initiative will be rolled out to Income and Corporation Tax, but not until at least April 2020.

Speak to a member of our team if you’d like to know more.