Where’s Best to Invest? The Low-Down on Growing a Nest Egg

Eventually, everyone reaches the end of their professional life. Investing in some assets, early on, can feather the nest you’ll be looking forward to on retirement. But investing can pay for new beginnings too – an…

5 Minute Read

Last Updated: 14th March 2022

Eventually, everyone reaches the end of their professional life. Investing in some assets, early on, can feather the nest you’ll be looking forward to on retirement. But investing can pay for new beginnings too – an eventual move on a house, for instance, or starting a family. So what’s the best and safest way to build cash, aside from a savings account?

Each investment strategy has its perks and drawbacks, which need to be assessed before you make a choice. Read on for our analysis of the key investment products open to anyone wanting to set a little extra aside…

Pensions

Most people have a state pension coming to them, but it may not be enough. As of the 2018/19 tax year, the new State Pension is set at £164.35 per week – far below what most of us would consider a healthy retirement fund.

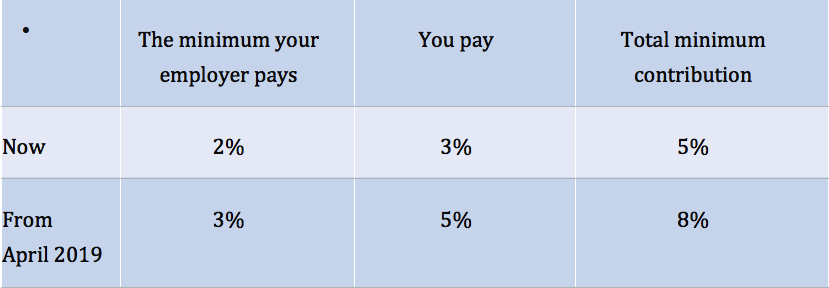

Workplace pensions are designed to complement the state pension. If you are an employee earning between £5,876 and £45,000 then your employer must enrol you in a workplace pension. They are then legally obliged to make contributions on your behalf. Employees are also required to make payments, although they can elect to opt out of the scheme if they wish. The government will usually add money to your pension in the form of tax relief.

The amount of contributions made are shown below.

Here’s a basic example of the tax relief available:

- You put in £40

- Your employer puts in £30

- You get £10 tax relief

A total of £80 goes into your pension.

Higher-rate income taxpayers can claim additional tax relief via their Self Assessment tax return.

Buy-to-let property

Some may say that property is more secure than a pension. That’s largely because the market for a personal pension may fluctuate, or that contributions could be put on hold if you’re let go or made redundant. Property will generally retain interest. The rental market is extremely buoyant in the UK – 2017 alone saw £50bn in residential payments across the nation. A property can bring significant rental income each month which can eclipse the mortgage you’ll pay and give you further income for the nest egg – although you may have to pay Income Tax on any rental profits.

In fact, it’s wise to pursue a buy-to-let (BTL) mortgage from a bank or reputable lender as their interest rates and fees will be competitive. You may also opt to have an interest-only mortgage to keep your monthly costs low. However, due to the fact that they are ‘interest-only’, the actual mortgage amount will need to be repaid as a lump sum at the end of the agreement. This is great if the property has increased in value, but could cause hardship if the property is worth less than the mortgage outstanding. To mitigate this, you can opt for a more traditional repayment mortgage. Whilst this increases your monthly outgoings, you are repaying a small amount of debt each month. Not only is this more prudent, it will also reduce the amount of interest you pay over the lifetime of the mortgage.

New landlords are not able to use a Help to Buy scheme, however. So, if BTL appeals to you, you will need to have some spare cash set aside to look for your first property. The amount required will change depending on whether you’re buying a flat, bungalow or two-storey home, but you would typically need to find a 25% cash deposit. Know your market before investing, and learn as much as you can from lettings agents. Landlords make a greater yield if they appeal to a specific demographic rather than painting a property as all things to all renters.

Stocks and shares ISAs

You may also consider an investment with your bank. NatWest, HSBC, Barclays and the like have numerous ISAs to look at, each of which funnels your money to a public or private asset. Government bonds are widely regarded as the safest option, and tend to deliver the lowest returns individually as a reflection of that low level of risk. Corporate shares sit on the other end of the scale. It is worth discovering where your appetite for risk lies by consulting with an investment analyst.

The earnings and any gains in an ISA are tax-free: that’s the basic reason for choosing them. But you have a limit on what to put into any ISA… Not just the stocks and shares variant. At the time of writing, the limit is £20,000 per year. This means you may, for example, put £7,000 into a cash ISA, and £13,000 into your stocks and shares account. Alternatively, you could invest £20,000 solely into stocks and shares, topping it up to the annual limit each tax year.

One thing about stocks and shares ISAs is that risk can change. As an investor, you can mitigate this by investing in safer areas – such as government bonds. When you get more confident with investment returns, you can change to a riskier strategy where the gains could be greater. However, there’s still the chance to lose a huge amount of money if something doesn’t go your way as investments can fall (as well as increase) in value. Ensure you monitor your ISA regularly so that you can change strategy if markets start to fall.

Cryptocurrency

Few aspects of the modern world are as mystifying to many of us as cryptocurrency trading. But it’s fairly simple when we break the term apart.

It’s best to think of cryptocurrency as a new form of investment that bypasses the difficulties you might have with foreign exchange. Crypto trade is a universal trade system. Supply and demand largely determines the price – or, as is the case with Bitcoin, a limited number is created, setting their market value to a certain amount unless demand starts to fall. Transactions are verified by others in the blockchain, which is to say, the network of users buying and selling the same coin. You can then sell them on too, or cash them out.

All that’s necessary to get started is to form and sync a digital wallet with your actual finance account, where you can store the cryptocurrency you purchase. To trade effectively, it’s advised to follow the crypto market closely, tracking the prices of coins so that you can make decisions on whether to buy or sell based on their value.

As ever, tax return software is essential for declaring your investment earnings over the years and decades to come. Use GoSimpleTax for assistance. It makes Self Assessment declarations straightforward and stress-free, with evidence collection and real-time tax calculation reporting on how much you’re due to pay. That’ll make saving a lot easier too – a nest egg gets bigger when it’s backed by knowledge…

Blog content is for information purposes and over time may become outdated, although we do strive to keep it current. It's written to help you understand your Tax's and is not to be relied upon as professional accounting, tax and legal advice due to differences in everyone's circumstances. For additional help please contact our support team or HMRC.

How to keep track of your side hustle income and expenses

16 Apr 2024

12 things business partners should know about Self Assessment

15 Apr 2024

Everything you need to know about payments on account

31 Mar 2024

How GoSimpleTax Works

Register

Simply register for free with your full name and email address.

Select Your Income

Select the income you receive and follow the hints and tips for potential tax savings.

Validate Your Information

Validate your personal information and submit directly to HMRC to get confirmation in just seconds.

Work Anywhere, With Any Device

Gone are the days of fretting over a calculator surrounded by scraps of paper at the eleventh hour.

GoSimpleTax’s tax return software uses the information you upload in real time to calculate your income and expenditure, working out the tax you owe and sending you helpful notifications when there’s the possibility of a mistake.

"The software is intuitive and proved very easy to navigate. I found the whole process refreshingly simple. I saved a lot of money too!"

Steve J.

Ordained Presbyter

"Easy to use and value for money. Everything you need to do your tax."

Gordon J.

Self Employed

"It fills in all the forms and sends them to the Inland Revenue. Not expensive either. Takes the stress out of doing your tax return online."

Ross G.

Team Rector